This Section 4 sets out the primary recommendations of this study that arise out of the discussion and analysis in Section 3. It is divided into two main divisions, this Introduction and the detailed recommendations set out in Sections 4.1 to 4.9. The final section 4.10 provides summary tables of all recommendations.

Given the scope and methodology of the study as set out in Section 2, the recommendations set out in Sections 4.1 to 4.9 have been developed against the backdrop of each jurisdiction studied, the wider considerations discussed in Section 3.1, and in view of the particular circumstances prevailing in Hong Kong. Over the past 20 years or so there have been innumerable discussions as to what aspects of the corporate governance (CG) system in Hong Kong are in need of development, particularly in response to the changing characteristics of the market and its makeup over that period of time. Accordingly, it is not the purpose of these recommendations to review and provide perspectives on those long-standing debates, except where they have again come to the fore in the course of the study. In some instances, revisiting a long-standing debate has been necessary, such as where there have been relevant changes in the underlying texture of CG concerns in the market, however, this has not always led to a recommendation being formed.

Formation of recommendations

A study that is essentially rooted in a comparison of the practices of other jurisdictions naturally gives rise to a variety of observations ranging from noting significant similarities of approach to fundamental differences. While differences are of course a source of considerable interest in the formation of recommendations, they must be measured or graded against a variety of factors. The balance and fit within one CG system as compared to another is clearly critical to assess. More difficult to measure, but nonetheless critical to take account of, is a consideration of what would be required to translate a practice in another jurisdiction to Hong Kong. This is not merely a theoretical exercise but one that requires an assessment of the ground conditions in the market itself, in brief, the difficulty or ease, or receptiveness or otherwise in an active and vocal market filled with a variety of commercial considerations and, consequently, viewpoints.

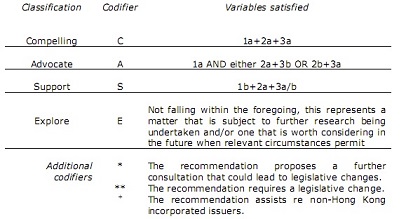

In deciding whether to propose a recommendation, the essential litmus test that has been adopted in this study is the probable utility, effectiveness and benefits of a potential recommendation under consideration. Subject to meeting that requirement, the recommendations as finally presented in this section of the Report have been formed with reference to the three sets of variables that are used as a framework for classifying recommendations, as explained in the Table on the next page.

Table: Classification of recommendations

Variables

1.the level of complexity involved to implement a recommendation, ranging from:

a.relatively straightforward (e.g. changes to regulatory rules or practices) to

b.wide ranging and complex (e.g. changes in regulatory a rchitecture or primary legislation)

2.the nature of support for a recommendation, being either:

a.from experiences in other markets

b.from principles (which may be based in experiences in other markets)

3.whether a recommendation is likely to be contentious to the industry, either:

a.unlikely to be contentious

b.may be contentious

(these two categories must be read relatively, given that any proposed change from the status quo may be met with objections from one or more segments of the industry)

Classification of recommendations

Assembling these variables into a framework, the four types of recommendation indicated below have been adopted to apply to each recommendation made in this Report. Each is merely a general indicator of overall support/difficulty. They are to be read more as a guide, not strictly. Certainly, just because something is more difficult to implement does not mean that it cannot be actively progressed and implemented.

Format of presentation

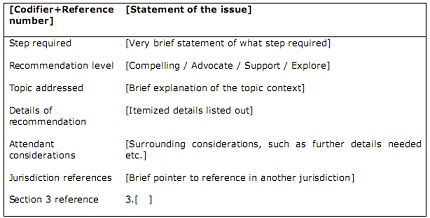

Where a specific matter has been considered and the investigation has led to a recommendation, these are summarized in following format:

References to the Main Board listing rules are intended to be addressed also to corresponding provisions of the GEM listing rules.

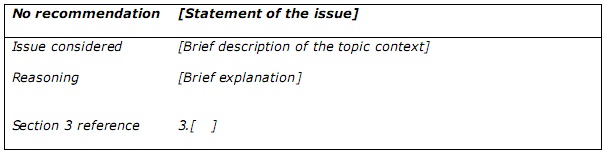

Where a specific matter has been considered, possibly with a view to making a recommendation, but the investigation has led to the conclusion that there are insufficient grounds to make a recommendation, these items are summarized in following format:

Main themes of the recommendations

A total of 28 recommendations have been made, including 20 falling within the «Compelling» and «Advocate» levels. These have been grouped in the sections that follow under four main divisions:

Part A - The board

Part B - Enforcement

Part C - Architecture and policy

Many of the recommendations can be linked together by some key threads that run through them. This includes, for example, seeking alternative or more effective enforcement mechanisms, finding solutions through use of existing powers as opposed to creating new ones, improving policy development and the marketing of good CG, exploring more effective empowerment mechanisms (shareholders, non-executive directors (NEDs), independent non-executive directors (INEDs)), improving transparency and accountability themes, and so on.

Much consideration was given to the specific question of shareholder rights and protections, this being a core purpose of the present study. Overall, the study indicated that shareholder rights are, insofar as strict legal rights are concerned, well established in Hong Kong law subject to three important caveats. The first is the ability of a shareholder to acquire information relevant to the identification of the infringement of a right. The second is the ability of the shareholder to pursue that right in practice. The third is in relation to what matters should a shareholder have rights of redress. Many of the recommendations made in the sections that follow are concerned with this issue.