Data analysis

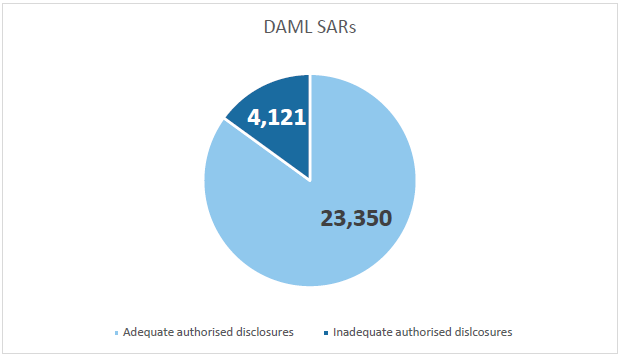

5.28 In order to test the provisional conclusions in our Consultation Paper, we analysed a sample of 563 authorised disclosures (also referred to as consent or DAML SARs). The following diagram shows the overall breakdown of results.

Analysis of authorised disclosures

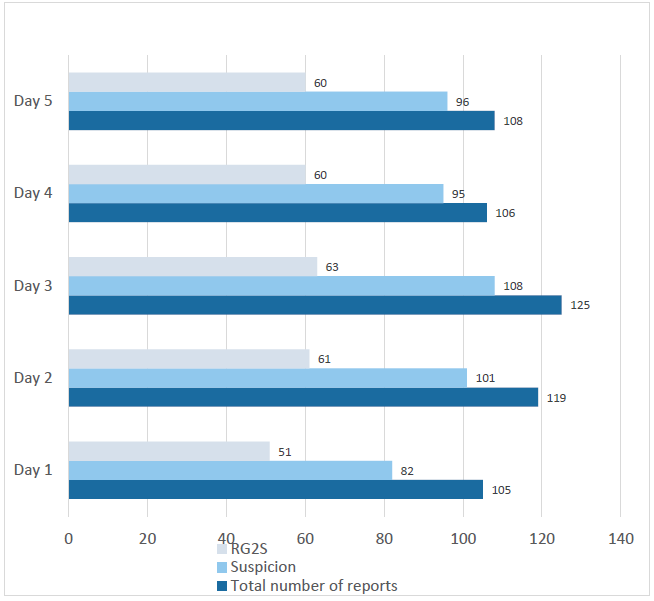

5.29 The quality of disclosures varied over the five-day sample that we examined. Of the total sample we considered, 482 out of 563 (85.6%) met the Da Silva test of suspicion. On Day 1, only 78% met the Da Silva test. On Day 2, 84% met the threshold of suspicion. On Day 3, this rose to 86.4%. On Day 4 the number of SARs reaching the suspicion threshold peaked at 89%. On Day 5, 88% of disclosures met the test. Our analysis demonstrates that, approximately 15% of authorised disclosures do not meet the test of suspicion on the face of the information provided in the SAR, which is as it was received by the FIU.

5.30 If we assume that this proportion is representative across all 27,471 authorised disclosures submitted between October 2015 and March 2017, approximately 4,121 would have been submitted unnecessarily. This confirms our provisional conclusion in the Consultation Paper that the UKFIU are devoting resources on authorised disclosures which do not even cross the threshold of suspicion. It is difficult to assess the cost to the UKFIU in terms of resources and any impact on other work with any accuracy.

5.31 During our examination of authorised disclosures, we also encountered significant numbers which revealed misunderstandings about the law. The presentation of the information varied in its level of detail and the ease with which it could be read and analysed by the FIU.

5.32 The following case studies, taken from our small-scale data analysis, provide illustrative examples of reporters making authorised disclosures which do not meet the test in Da Silva. Each of these examples resulted in a subject's account being frozen and access to their funds restricted for a period of time.

Case Study 1: Application of suspicion

A high street bank lodged a SAR seeking consent to proceed with a transaction valued at under £100. The transaction involved the intended transfer of legitimate funds for the purchase of an unknown item from an ordinary retail business in Amsterdam. The reporter was concerned that there was a theoretical possibility that the customer may purchase lawful items that could be used by a drug user. The customer's bank account was frozen and they were unable to access any funds until consent was obtained from the UKFIU.

Case Study 2: Application of suspicion

An automated alert was generated within a large bank. It was reviewed and closed internally as the financial investigator was satisfied that there was no suspicious activity. A second investigator reviewed and made a report without any identifiable reasons for suspicion beyond the original automated alert.

Case Study 3: Application of suspicion

A British professional of minority ethnic origin arranged a transfer of funds to purchase a property. The funds were being sent from their parents' country of origin and documentation as to the source of the funds had been provided. The reporter lodged an authorised disclosure on the basis that they had never dealt with a transaction from the relevant country before and therefore made a report out of caution.

Case Study 4: Application of suspicion

The suspicion identified in the disclosure was based on informal pre-suspicion information sharing between credit institutions. The reporter acknowledged that their report was solely based on another credit institution's suspicion.

5.33 Our research confirms our provisional conclusion that the test of suspicion is being inconsistently applied by reporters. In addition to the deployment of UKFIU resources to process these disclosures, there is also an impact on the quality of intelligence provided in these reports. As the automatic consequence of an authorised disclosure is that the financial transaction is paused, this can have a significant effect on those who are the subject of a disclosure.

Case Study 5: Impact of an authorised disclosure

A barrister and small business owner became aware that both his personal and business bank accounts with a large retail bank had been frozen at Christmas-time. He was left with only £20 in cash and was unable to access any funds. He telephoned his bank and they were unable to tell him why his accounts had been frozen. He feared being unable to pay his employees at the end of the month. His regular mortgage payment was also due. He sought and was granted an urgent injunction to provide access to his bank accounts. He was only able to do so with the assistance of his solicitor who gave an undertaking to pay the issue fee to get the application listed. Although his accounts were unfrozen, the bank provided him with notice of closure and informed him that they were terminating the business relationship. He reported encountering great difficulty in opening new personal and business accounts with another high street bank.