The UK CG Code requires that INEDs have sufficient time to devote to their responsibilities, disclose to the board their other significant commitments, and keep the board updated of any changes thereto. Although the UK CG Code suggests that the number of non-executive posts at other companies a full time executive director can take on be capped at one, there is no cap suggested for the number of posts that can be taken on by INEDs. A survey undertaken by the UK's Institute of Directors in 2016 suggests that stakeholders are not especially concerned with the average number of boards a director sits on (see Appendix II.1.1).

In the United States, the NYSE Listed Companies Manual also does not impose any limits on the number of boards on which an independent director may sit, although it does state that companies may choose to address other substantive qualification requirements of independent directors, including policies limiting the number of boards on which a director may sit.

In Mainland China, independent directors are not allowed to hold more than 5 such positions at any given time and must ensure that they have sufficient time and energy to discharge their duties. There are prescriptive requirements on attendance too. If INEDs fail to attend the meeting of the board of directors for three times consecutively, the board of directors may request the shareholders general meeting to replace the INEDs. Directors are also required to attend training. Independent directors and newly appointed independent directors should participate in training organized by the CSRC and its authorized institutions according to the requirements of the CSRC. This is more prescriptive than Hong Kong.

Singapore does not impose any restriction on multiple directorship in Singapore, the Code merely providing that when nominating directors, the Nominating Committee should consider if a director is able to, and has been adequately carrying out his/her duties as a director, taking into consideration the director's number of listed company board representations, and other principal commitments, and the board should determine the maximum number of listed company board representations any director may hold, and disclose this in the annual report.

Hong Kong

Following a consultation exercise undertaken by the HKEX in 2010 to 2011, the HK CG Code contains a general requirement, applicable to all directors, that they should devote sufficient time and attention to undertaking their role, and a specific requirement that INEDs should give the board and its committees their regular attendance. Like the UK CG Code, there is no cap suggested for the number of posts that can be taken on by INEDs, although the HKEX's 2017 consultation on the CG Code does, as discussed below, does touch upon this issue. However, unlike the UK CG Code, there is no express requirement that other commitments be disclosed to the board.

Discussion

While most of the interviewees expressed some consternation surrounding the role of INEDs, none appeared to be concerned as to the issue of the disclosure of other significant interests to the board upon appointment or thereafter. The general sense is that issuers will normally take this into consideration as a matter of prudent commercial practice - indeed, it is likely to be their fiduciary duty to do so insofar as ensuring that any potential conflicts of interest are known through disclosure, such as an individual also occupying a position as a director on another company perceived as a competitor. Apart from this commercial common sense, it should also be pointed out that, as discussed in Appendix I.4.1, directors of all Hong Kong listed issuers, including INEDs, are in general subject to the same fiduciary duties - i.e. being those of the director of Hong Kong incorporated company. Among those duties is the duty to avoid conflicts of interest.

It was also understood from the interviews that the issuer would be sufficiently familiar with the INED to be aware of developments in the interests of the INED as time passes by. This is a characteristic boon and burden to the INED situation in Hong Kong - familiarity brings with it a more intimate relationship between an INED and the board while at the same time casting doubts as to the quality of an INED's independence.

The identification of a difference between different regulations across jurisdictions presents a continuing temptation to suggest that a new rule be made to close out the gap. However, given the foregoing considerations, there seems little to be gained through the addition of a rule dealing with the formal disclosure of an INED's other interests. Rather, it is suggested that the addition of such a rule would only need to be considered contingent upon other more fundamental changes to the responsibilities and accountability of INEDs.

Almost all interviewees expressed considerable concern as to the phenomenon of INEDs holding a sufficiently large number of INED posts in multiple issuers that it raises the practical question of whether they are able to fulfill their basic responsibilities since there is a logical point beyond which the INED will have insufficient time to undertake their responsibilities properly. This is particularly the case during the usual financial reporting seasons, particularly as the functions of the audit committee are undertaken by non¬executive directors only, at least one of whom must be an INED. Almost all interviewees agreed that imposing a cap on the number of posts that could be held would be a sensible mechanism to control this problem, however, by what means should that cap be set was entirely unclear. This sits at odds with the «overwhelming majority» of responses to the HKEX's 2010/2011 market consultation opposing such a cap. However, the consultation responses require some clarification, which was lacking in the HKEX's conclusions paper and remains unquantified in their most recent consultation. First, the suggestion that multiple directorships in Hong Kong are uncommon can be quantified: as discussed in Appendix I.7.2, 65 INEDs hold six or more seats, which represents only 1.25% of all INEDs (increasing to 3.83% for INEDs who hold 4 or more seats). Second, the 2011 consultation response that not imposing a limit may encourage a culture of professional directorships in Hong Kong, where more qualified and experienced individuals could build careers providing independent advice to board members would, based on the statistics cited above, appear to be only relevant to a small though not insignificant number of individuals. Moreover, as discussed below, there is very little evidence this is developing - instead, career INEDs appear to be taking trophy posts with very little professionalism exhibited. This is reflected by anecdotal descriptions of some INEDs, when queried by the regulator regarding a possible corporate wrongdoing, denying they have any responsibility on the grounds that they are only an INED and don't know anything about the company's affairs. In this context, one must query whether there is any sense in the SEHK relying on the responses of a majority that may be self-serving and not in the best interests of the market.

HKEX's most recent (November 2017) consultation suggests placing a soft cap of six other posts held by INEDs such that where seven or more posts are held an explanation is required from the board why the person would still be able to devote sufficient time to the board, i.e. to be able to fulfill their duties as directors. While the HKEX does not state from where the number «six» was derived, it is suggested that the proposed requirement effectively sanctions as acceptable, and so not in need of any explanation, an INED holding posts at multiple issuers, up to and including six. The HKEX's proposal therefore runs the risk of validating multiple appointments at least up to six, without addressing the underlying concern about a director having sufficient time and attention to devote to their duties. Under the research already referenced above, the HKEX's proposal would affect 0.85% of all INEDs, which suggests that the consultation proposal also serves little purpose in practice. There are a wide variety of circumstances affecting INEDs, including not only their other obligations but also their personal skills, capabilities and sense of responsibility.

There is an active discussion in Hong Kong about the role of INEDs and to what extent they can properly undertake the role to serve the underlying purpose of having INEDs on the board, which is in part to assure investor confidence by acting as a check and balance on the powers of the executive directors engaged in running the day to day business of the company. While the context of Hong Kong is very different from Mainland China, which has imposed strict caps, it is suggested that issuers in Hong Kong should adopt a policy that is disclosed to shareholders, with deviations from it also being explained. This leaves it to issuers to decide and shareholders to assess, in each case in view of the circumstances of each company.

The foregoing leads to Recommendation A4.2.1 «Sufficient INED time».

Almost all of the interviewees expressed concern that there are too many INEDs of listed issuers in Hong Kong who do not fully appreciate their role on the board and take up INED roles as trophy posts - as illustrated by the above anecdotal evidence. A variety of factors were discussed that influence the ability of an INED to be effective including:

the experience and skill set of the individual;

their personality, as an independent thinker or challenger as compared to someone that perceives themselves to be performing a confirmation role;

the individual's technical understanding of their role and potential liabilities as an INED (whether on the board or in specific sub-committees of the board), the extent to which they have received training on this, and the extent to which board processes support and confirm that role;

the willingness of the individual to become involved;

their ability to become involved (assuming willingness) being affected by board processes, an example being given, apparently not uncommon, of receiving lengthy briefing papers only just prior to the board meeting at which they will be discussed;

the degree of information asymmetry between executive and non-executive directors;

the amount of time they are expected to devote to undertaking their role and to what extent this is or is not confirmed by board practices (such as late delivery of briefing papers as mentioned above);

the level of remuneration received, which can be (wrongly) perceived as a proxy for how much effort they should put in or alternatively as a compensation to receive their confirmation, or for their liability.

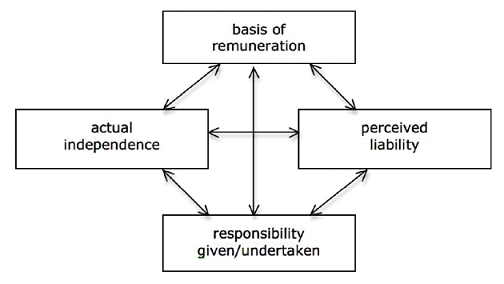

Together, these give rise to an inherent de facto relationship between independence, the responsibility given and undertaken, remuneration and perceived liability, as shown in the diagram below.

Factors impacting on the INED role

Solving this problem is not a simple one. Considering each of the boxes in Diagram 1, it might be asked which can best be manipulated to bring about improved INED standards to the market more generally?

Actual independence: Independence has already been discussed in Section 3.7.9 "Determination of independence" above.

Basis of remuneration: The point has already been made in Section 3.4.3 "Remuneration" that where an INED's remuneration amounts to a token fee little is likely to be expected of them in terms of their actual responsibilities, and this supports a (mis)understanding of reduced liability. It is probable that a low remuneration indicates they are not expected to do very much save as is sufficient to ensure the INED requirements are met on a box-tick basis - anecdotally, the current market rate for INEDs is typically around HK$10,000 to HK$20,000 a month (Main Board and GEM issuers). The disclosure proposed by Recommendation A4.2.2 "Basis of INED remuneration" is a step toward more openly discussing why an INED is receiving a certain level of remuneration, and by implication what is expected of them.

Responsibility given/undertaken: As regards expected requirements, the HK CG Code does indicate a number of roles required to be undertaken by INEDs in relation to sub¬committees of the board. However, the extent to which an INED actively engages in the relevant role remains open to doubt and can vary from company to company.

Perceived liability: While actual liability is a matter of law, perceived liability is a product of the foregoing two factors as well as what an INED thinks they are expected or required to do and the individual's perceived risk of liability in performing or not performing the relevant requirement.

What INEDs see in the market in terms of the frequency and severity of enforcement activity, and how clearly they regard it as potentially concerning themselves, is relevant to consider as a factor influencing the relationship between these boxes. Research in the UK and Singapore found that independent directors face little threat of civil liability and disqualification orders are hardly made against independent directors of publicly traded companies. Even in the United States where shareholder actions are more common, independent directors are exposed to very little personal liability risks in civil trials as they are often covered by a directors' and officers' insurance, unless civil proceedings are brought by government regulators against them.

While it is tempting to conclude this suggests there should be more enforcement, it is suggested that the basis for enforcement should more specifically express what is expected of an INED. In other words, to bring INEDs more clearly into the public framework of responsibility and accountability in a manner that supports their function. Relevant examples of this are provided from both the UK and the United States. In the UK, an independent director has special powers in relation to the question of whether a controlling shareholder has complied with its undertakings under the «relationship agreement» (see Section 3.7.12 «Empowerment of INEDs - controlling shareholders», and Appendices II.1.2 and II.7.3). In the United States, greater significance and responsibility was brought to bear on the audit committee by requiring them to make a disclosure in the annual report (see Section 3.3.4 «Audit committee»).

Such examples give rise to a suggestion that the public framework of responsibility and accountability of INEDs in Hong Kong could be evolved by requiring them to make disclosures, for example by way of an INED report in the annual report, as has been implemented in Mainland China as discussed below. Doing so places INEDs in a much more visible position that demonstrably supports the importance of the role they are expected to undertake. However, it would also be desirable, or perhaps necessary, to provide appropriate support for INEDs - for example, to avoid situations where they are placed in an information-deprived position that hampers them in the performance of their role, such as receiving board papers with insufficient time to review them before a board or committee meeting.

In terms of disclosure on INED's work, Mainland China has adopted guidelines that require a lot of disclosure. If the independent directors disagree themselves and are not able to reach the consensus, the board of directors shall disclose the independent directors' respective opinions separately. The requirement of disclosure gives the public an insight into the black box of the board and make independent directors more visible and so accountable to shareholders. However, it has been pointed that the independent director system in Mainland China still has its limitation, despite their powers and the above mentioned disclosure requirements, because they are nominated by the manager and appointed by controlling shareholders so they are not truly independent, and they have limited access to corporate information in practice and rely on the manager for the information.

One way of bringing these themes together is to suggest that the listing rules be amended in two ways.

First, to introduce a mandatory requirement that INEDs make a statement in the Corporate Governance Report as to their activities relating to the undertaking of their role over the course of the year. Some of the interviewees concurred in the view that independent directors should report annually on their work, in particular, how they review and approve connected transactions. The concept of introducing formal board evaluation has been discussed in Section 3.3.3 «Board evaluation» and an annual INED report could encompass the evaluation process.

Second, issuers could be required to adopt a code that addressed specified matters concerning all non-executive directors (NEDs) including INEDs. NEDs are less frequently discussed but nevertheless present a similar matrix of problems and concerns as discussed in relation to INEDs, albeit without less emphasis on their role as an assurance of investor confidence. Some of the interviewees agreed that such a Code would be a meaningful companion to facilitate the effectiveness of the INED role, and could also serve to clarify the role of NEDs. The minimum range of matters that require coverage would need to be studied further but could be set out in a Model NED Code that an issuer may choose to comply with or alternatively establish their own NED Code. Such a code would cover matters such as the issuer's policies and practices in relation to: the selection and appointment of INEDs and other NEDs including in relation to matters such as skills and diversity; the board's expectations of INEDs and other NEDs; the minimum time for circulation of board papers prior to board meetings; conducting INED and other NED pre-board meeting briefings; steps taken to minimize executive/non-executive information asymmetries; facilitating the familiarity of INEDs and other NEDs with the business through site visits and regular training, etc.; requiring a resigning INED or NED to make a statement setting out reasons for their resignation; and the other appointments of INEDs and other NEDs (including whether it applies any cap on the number of other appointments - for the reasons discussed above, sanctioning a certain number of multiple directors as acceptable may be less progressive than requiring a board to form and to follow a disclosed policy). Some of these matters reflect concerns expressed in the UK's Turner Review and Walker Review as well as in other jurisdictions, as discussed next.

The foregoing leads to Recommendation C4.2.4 «NED Code and INED reporting».