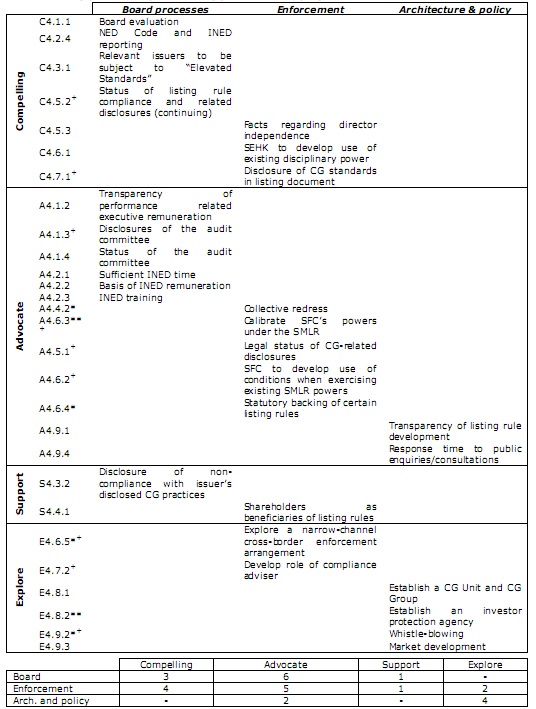

This section presents two summary tables.

Table 1 lists out all the recommendations made by part, i.e. according to their order discussed in the above sections concerning board processes, enforcement, and architecture & policy.

Table 2 groups the recommendations according to their classification, i.e. Compelling, Advocate, Support, Explore. The total number of types of recommendations in each category is shown at the foot of Table 2.

Table 1 - Summary of all recommendations - by part

Part A - the Board

4.1 Processes

C 4.1.1 Board evaluation

A 4.1.2 Transparency of performance related executive remuneration

A 4.1.3+ Disclosures of the audit committee

A 4.1.4 Status of the audit committee

4.2 Independent directors

A 4.2.1

A 4.2.2 Sufficient INED time

A 4.2.3 Basis of INED remuneration INED training

C 4.2.4 NED Code and INED reporting

4.3 CG standards

C 4.3.1, S 4.3.2 Relevant issuers to be subject to "Elevated Standards» Disclosure of non-compliance with issuer's disclosed CG practices

Part B - Enforcement

4.4 Shareholders

S 4.4.1, A 4.4.2* Shareholders as beneficiaries of listing rules Collective redress

4.5 CG disclosures

A 4.5.1+ Legal status of CG-related disclosures

C 4.5.2+, C 4.5.3 Status of listing rule compliance and related disclosures (continuing) Facts regarding director independence

4.6 Regulators

C 4.6.1 SEHK to develop use of existing disciplinary power

A 4.6.2+, A 4.6.3**+ SFC to develop use of conditions when exercising existing SMLR powers Calibrate SFC's powers under the SMLR

A 4.6.4* Statutory backing of certain listing rules

E 4.6.5*+ Explore a narrow-channel cross-border enforcement arrangement

4.7 Ex ante mechanisms

C 4.7.1+

E 4.7.2+ Disclosure of CG standards in listing document Develop role of compliance adviser

Part C - Policy and architecture

4.8 Architecture

E 4.8.1

E 4.8.2** Establish a CG Unit and CG Group Establish an investor protection agency

4.9Policy

A 4.9.1 Transparency of listing rule development

E 4.9.2*+ Whistle-blowing

E 4.9.3 Market development

A 4.9.4 Response time to public enquiries/consultations

Table 2 - Summary of All Recommendations - by Type